- VA loan assumptions let buyers take over a seller’s low interest rate, potentially saving thousands.

- Veterans and non-Veterans may assume a VA loan, but entitlement rules may affect future VA loan use.

One of the under-the-radar benefits of VA loans is the option for loan assumption. While this feature wasn’t a major factor in recent years due to historically low mortgage rates, today’s higher rates have made it an attractive opportunity for buyers and sellers alike.

A VA loan assumption allows a homebuyer to take over an existing VA loan, including its interest rate and remaining balance. This can be especially valuable in a high-rate environment, potentially offering homebuyers a lower mortgage payment compared to taking out a new loan.

For VA homeowners, offering an assumable loan can be a powerful selling point. Assumptions generally come with lower fees and fewer closing costs than a traditional home purchase. However, there are important considerations for Veterans allowing their loan to be assumed by a non-Veteran.

Are VA Loans Assumable?

Yes, VA loans are assumable as long as the potential homebuyer meets the lender's requirements. Taking over a VA loan with a low interest rate can be a major advantage, especially when rates are rising. But assumptions can also present some risks for the Veteran allowing their loan to be assumed.

Like every mortgage tool, loan assumptions come with both benefits and drawbacks. First, let's take a look at the potential benefits of a VA loan assumption.

Potential VA Loan Assumption Benefits

For homebuyers, the two biggest benefits of a loan assumption are rooted in cost savings. An assumption means you can take advantage of the low rate a homebuyer locked down months or even years prior, when the housing market looked a lot different.

Significant Monthly Savings

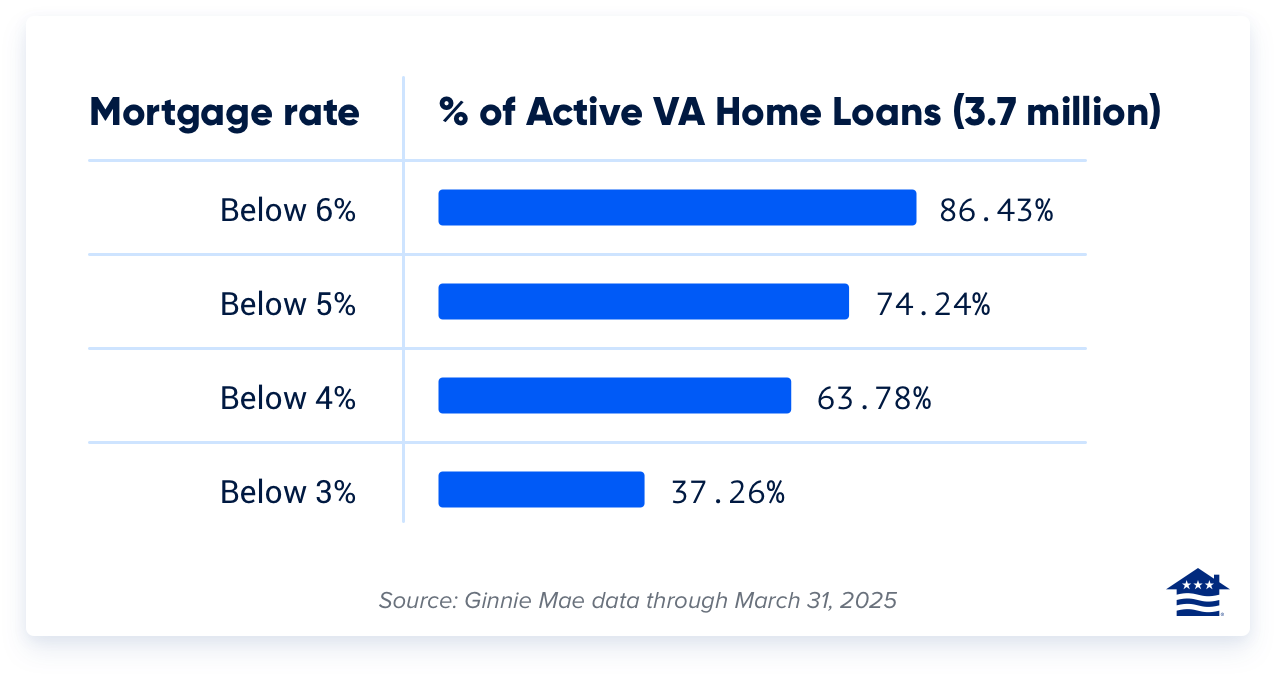

About 74% of VA homeowners have a mortgage rate below 5%, according to a Veterans United analysis of Ginnie Mae data through March 2025:

Securing a lower interest rate can have a huge impact on housing affordability.

For example, on a $400,000 loan with a 7% interest rate, the monthly principal and interest payment comes out to about $2,660. With a 3% rate, that payment drops to $1,686. That's nearly a thousand-dollar difference in monthly housing costs.

In today's market, would-be buyers can't get a rate anywhere close to that 3% to 5% range right now.

Low Costs and Fees

The other money-saving benefit of a VA loan assumption is that they come with few costs and fees, especially compared to a traditional purchase loan. Most of the closing costs associated with a VA purchase aren't part of an assumption.

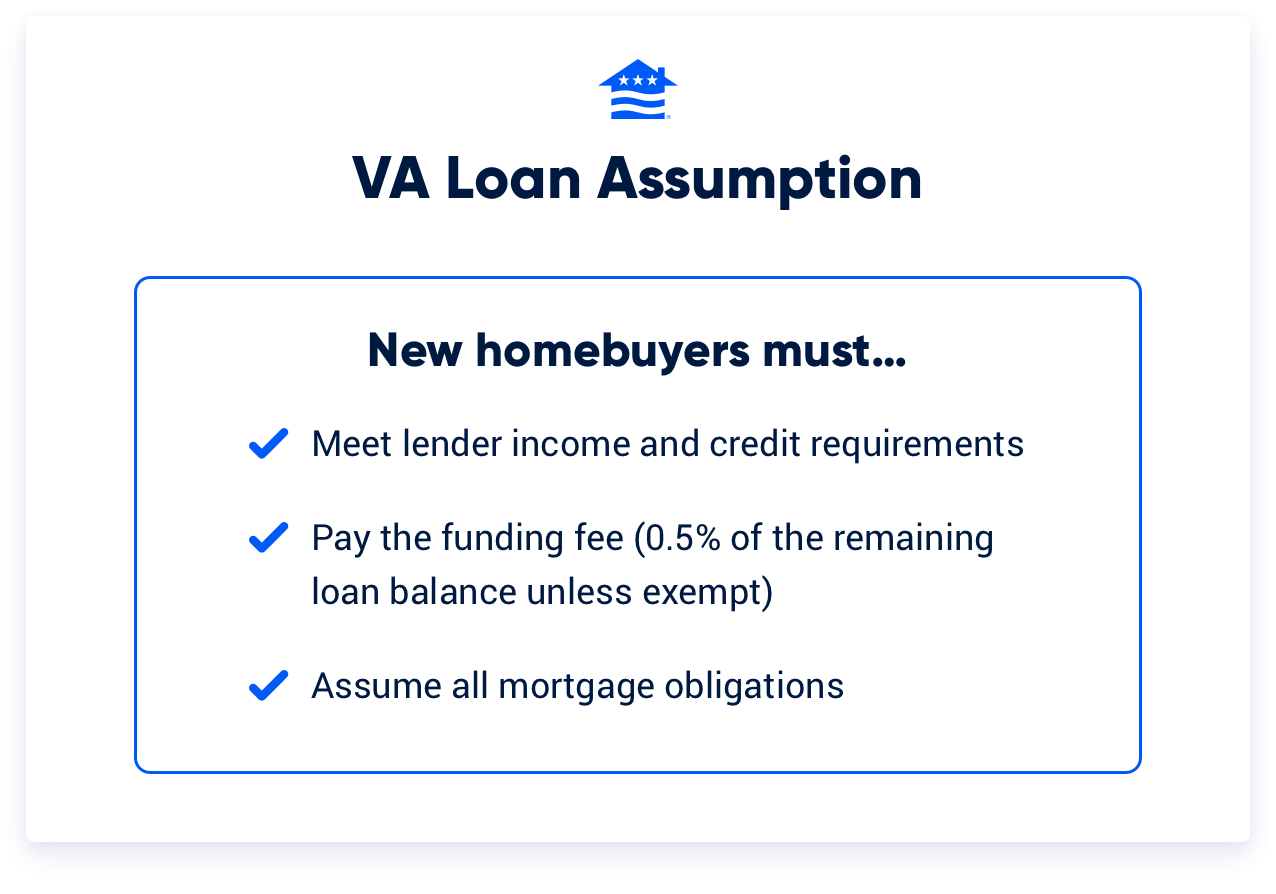

The person assuming the loan does pay a funding fee of 0.5 percent of the loan balance. That fee goes directly to the VA and helps keep the loan program running for future generations of military buyers. Veterans who would typically be exempt from the VA Funding Fee are also exempt from this assumption fee.

Loan assumers might also want to pay for an appraisal, but those aren't required with loan assumptions.

Can Non-Veterans Assume a VA Home Loan?

Yes, anyone can assume a VA loan as long as they meet the lender’s criteria. However, VA homeowners take on some risk when a civilian assumes their VA loan because the Veteran's entitlement is tied to it.

Potential VA Loan Assumption Challenges

Now let's take a look at some of the challenges of a VA loan assumption. There's one big one for prospective buyers and one facing VA homeowners.

Cashing Out Homeowner Equity

Would-be buyers don't just waltz in and take over a Veteran's mortgage without paying for the privilege. Homeowners want to make sure they capture whatever equity they've built in the property, otherwise there's no benefit to allowing for an assumption.

For example, let's say the VA homeowner has $350,000 remaining on their loan, and they're selling their home for $450,000. The person assuming the loan would need to pay the homeowner $100,000 at closing in order for an assumption to make sense.

In most cases, loan assumers cover that cost in cash, which can be a tall order for some consumers. But it might be possible to obtain secondary financing to pay out the homeowner's equity at closing. Lenders will likely include that debt when they consider a loan assumer's overall debt and income situation.

In either case, would-be buyers need to figure out how they'll cash out the homeowner's equity in order to make a VA loan assumption work.

Impacts on VA Loan Entitlement

For VA homeowners, the big consideration with allowing an assumption is their VA loan entitlement. If the person assuming your loan is a Veteran with sufficient VA loan entitlement, then you can ask them to formally substitute their entitlement for yours on that mortgage.

Otherwise, the entitlement you utilized to purchase the home will remain tied up there until the loan is fully repaid.

Failing to get a substitution of entitlement can limit your 0% down purchasing power when it comes time to reuse the VA loan benefit. It's also possible you wouldn't have enough entitlement remaining to reuse the benefit at all.

VA homeowners also lose that portion of their entitlement entirely if the assumer later experiences a foreclosure or short sale.

In other words, allowing a civilian to assume your VA loan can affect your future use of the VA loan benefit. For some homeowners, that's a risk worth taking. Others ultimately decide to allow for assumptions only to Veterans substituting entitlement or to pursue a traditional home sale.

How to Find Assumable VA Loans

There are a few different ways to find assumable VA mortgages:

- Work with a real estate agent: Most agents have access to the Multiple Listing Service (MLS) and can help you easily locate homes with assumable VA loans.

- Search online real estate listings: Some sellers highlight their assumable mortgage in their listings to attract buyers on major home listing sites.

How to Assume a VA Home Loan

Veterans and civilians who want to assume a VA loan first need to find them. A good real estate agent can help, but home listings on major sites are increasingly referencing assumability as a major benefit.

Generally, a home with a VA or FHA loan is assumable. Conventional mortgages in most cases are not.

The VA has broad assumption guidelines. Lenders and servicers holding these loans will likely have their own unique requirements that would-be assumers must meet.

Guidelines and requirements might include:

- Acceptable credit score

- Acceptable debt-to-income ratio (DTI)

- Sufficient assets

- Satisfactory credit history

- Employment verification

If you're looking for an assumption, you'll be dealing with the lender or servicer that made the original VA loan. Lending guidelines, processes and time lines will vary.

Are Veterans United’s Loans Assumable?

Veterans United’s VA loans are assumable, but not all loan types offered by Veterans United have assumability. Borrowers with VA loans through Veterans United have the option to transfer their loans to another eligible individual, subject to VA approval. However, assumability does not apply to other loan types offered by Veterans United, such as conventional and FHA loans.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Jul 15, 2025

Written ByChris Birk

Reviewed ByTara Dometrorch

Incorporated expert insight about assuming a VA loan from Associate Directors of Production.

Jun 20, 2025

Written ByChris Birk

Reviewed ByTara Dometrorch

Updated data figures to reflect 2025 data.

Dec 13, 2024

Written ByChris Birk

Reviewed ByTara Dometrorch

Updated to improve readability. Content also fact checked and reviewed by team lead underwriter Tara Dometrorch.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.