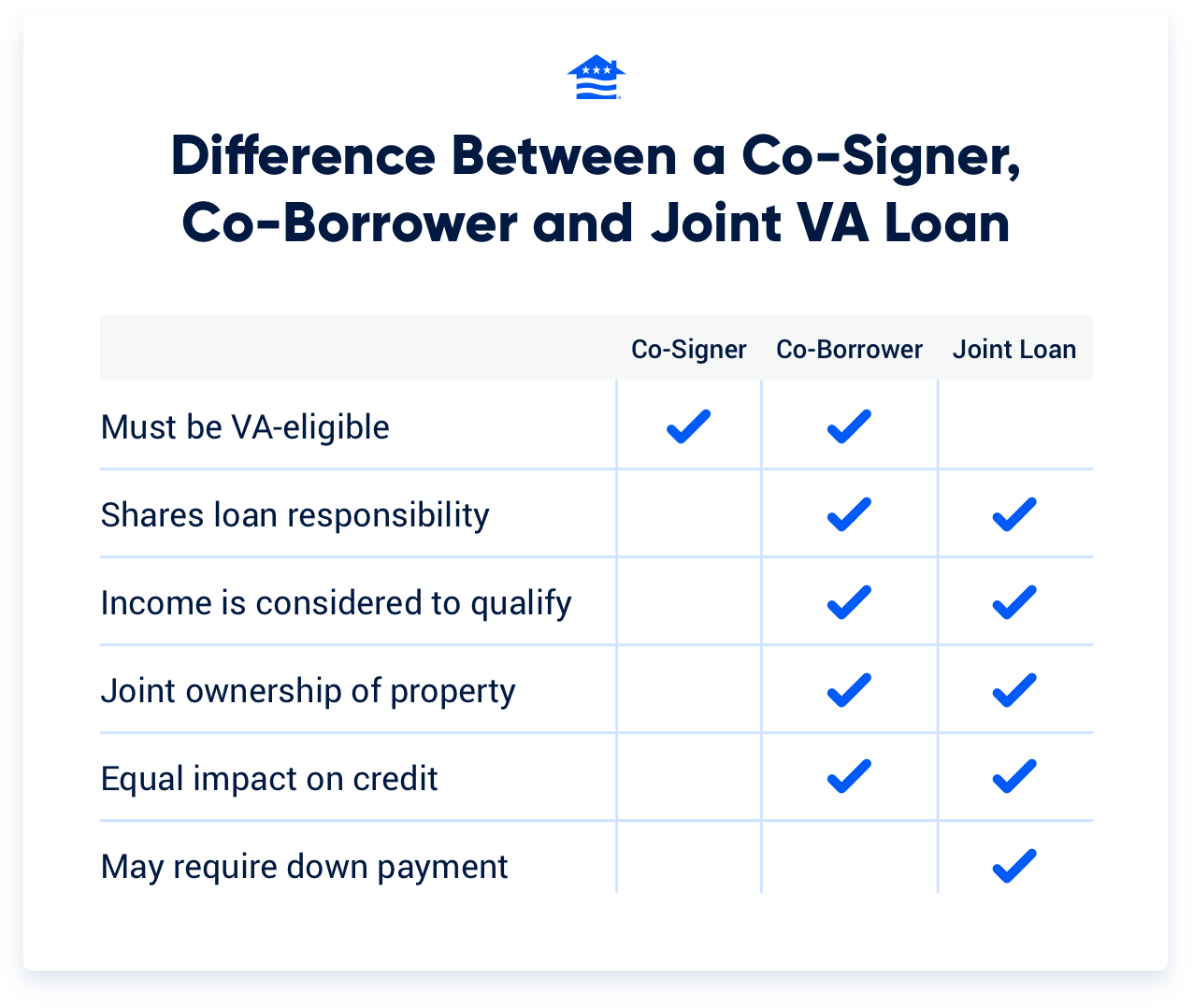

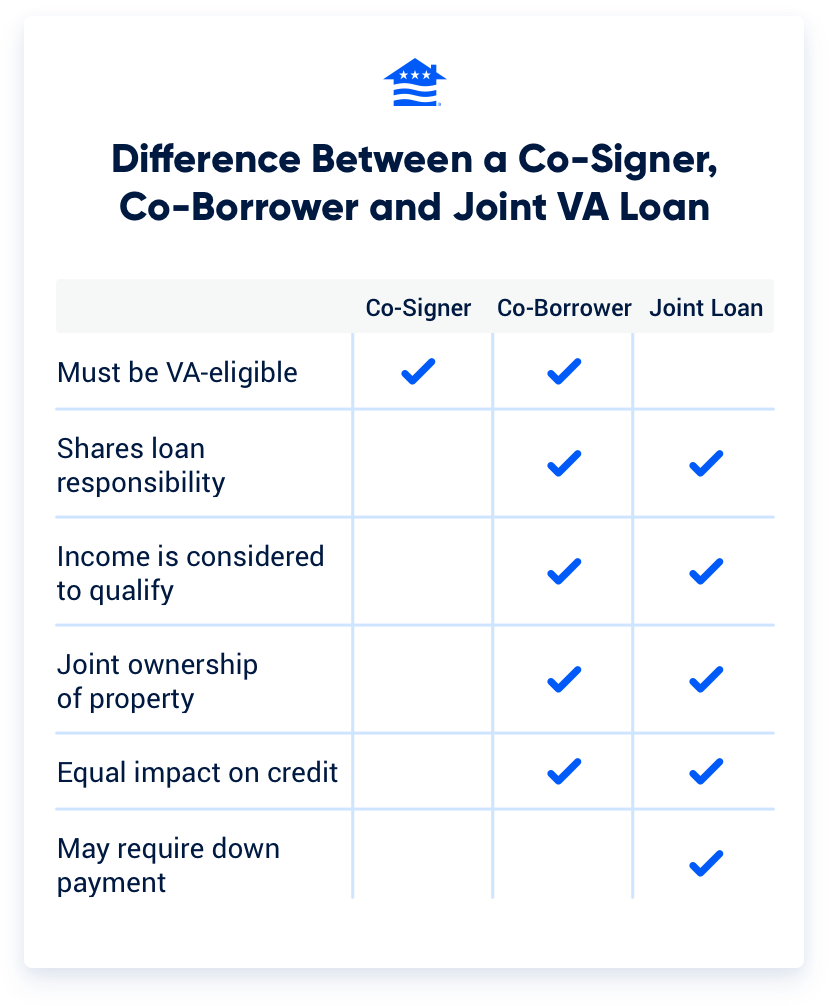

- Co-signers do not hold ownership and must be qualified military members or spouses.

- VA loans allow co-borrowers as long as they occupy the home and meet financial guidelines.

- Joint VA loans with non-spouse, non-Veteran co-borrowers are possible but may require a down payment.

Many Veterans who utilize the VA loan do so with another applicant. It often makes sense for prospective homebuyers to want or need another applicant on their VA loan. Using another person's income, credit score and debt level can do wonders for loan qualification.

However, not all co-borrowing scenarios are easy, and some may be harder than others. Below we break down everything a Veteran should know about VA loans with multiple applicants, including co-signers, common co-borrower scenarios and requirements.

Can Someone Not in the Military Co-Sign on a VA Loan?

To receive the most out of the VA loan benefit, co-signers must be qualified military members or spouses. The VA will only guarantee the eligible Veteran’s part of the loan. If the co-signer is not a spouse or an eligible Veteran, it's best to look into a joint VA loan.

Co-signers do not have property ownership on a VA loan. However, if the homeowner defaults on the loan, the lender will hold both the homeowner and the co-signer responsible. Most often, VA loan co-signers are used to help homebuyers qualify for the loan when their personal finances are not strong enough.

Do VA Loans Allow Co-Borrowers?

Yes, VA loans allow co-borrowers on the loan. Acceptable co-borrowers include a Veteran and non-Veteran spouse, two married Veterans where only one Veteran uses their entitlement, two married Veterans where both Veterans use their entitlement and two non-married Veterans where both Veterans use their entitlement.

The VA also allows what's known as a joint VA loan, where the Veteran applies with a non-Veteran, non-spouse.

VA Loan Co-Borrower Requirements

A co-borrower on a VA loan typically includes the Veteran and their spouse but may also include another Veteran who isn't their spouse.

Co-borrowers on VA loans must live in the home and meet the same financial guidelines as other VA loan applicants. In some cases, this can help. In other cases, it may hurt. Counting someone else's income can come at a cost — you're at the mercy of their credit and financial profile.

Every applicant on your loan needs to meet the VA's and lender's requirements for things like minimum credit score, debt-to-income ratio and more.

VA-Approved Co-Borrowers

The VA typically allows a max of four borrowers on any loan. For co-borrowing, this includes:

- A Veteran and non-Veteran spouse

- Two married Veterans where only one Veteran uses their entitlement

- Two married Veterans where both Veterans use a portion of their entitlement

- Two non-married Veterans where both Veterans use a portion of their entitlement

The VA doesn't expressly prohibit non-spousal co-borrowers. In those instances, the agency tells VA lenders that it will only guarantee the eligible borrower's portion of the home loan. That leaves a chunk of the mortgage without the government backing the program relies upon.

Does that mean you can't secure a VA loan with your fiancé or fiancée, your long-time significant other or your civilian neighbor? No.

Let's take a quick look at joint VA loans.

Joint VA Loans

Lenders, including Veterans United, provide joint VA loans for Veterans and non-spouse, non-Veteran co-borrowers. For example, if a Veteran got a VA loan with their brother, parent or unmarried significant other, that would be a joint VA loan.

Joint VA loans are absolutely possible, but they look different from a typical VA purchase loan. They're different because the VA's guaranty extends only to the Veteran's portion of the loan (half in most cases).

Most of the time, joint loans wind up requiring a down payment to account for the part the VA doesn’t guarantee. The amount depends on a few factors, including entitlement and the home's price.

Common VA Loan Co-Borrowing Scenarios

Let's look at some VA loan co-borrowing scenarios and how they might play out in your VA loan process.

Scenario 1: VA-Eligible Borrowers and Unmarried Partners

Some co-borrowers will be subject to more financial scrutiny than others. If you plan to co-borrow with an unmarried, non-Veteran partner or friend who will live in the home with you, plan on needing money for a down payment. Remember that the VA will only guarantee the VA-eligible borrower's portion of the loan. This also applies to VA refinancing.

Scenario 2: VA-Eligible Borrower and Spouse

Having a non-Veteran spouse or eligible Veteran on the loan with you doesn't trigger any down payment needs. The ability to purchase with $0 down is a significant financial benefit of the VA loan, and nearly 8 in 10 VA buyers took advantage of it last year alone.

Scenario 3: Two Married or Unmarried VA-Eligible Borrowers

Two eligible Veteran borrowers have some options when it comes to using their VA home loan benefits. You can use all of one borrower's entitlement and save the other for future use. You can also split your entitlement evenly or combine the remaining entitlement of one borrower from a previous VA home loan with the remaining entitlement of the other borrower.

If your co-borrower is also a Veteran or a service member with VA loan entitlement, you may want to take a closer look at dual entitlement options for military couples pursuing VA home loans.

Scenario 4: Non-Occupant Co-Borrower

In certain situations, VA loans allow non-occupant co-borrowers, such as a spouse who won’t immediately live in the home.

For example, a Veteran and their spouse currently live in Georgia. After accepting a new job in Missouri, the Veterans needs to purchase a home in that state. However, their spouse won't move immediately and must remain in Georgia for work for the next five years.

At Veterans United, the loan may still be approved as long as the Veteran plans to live in the home and the spouse’s income is stable.

VA Refinance and Co-Borrowers

Co-borrower relationships can get tricky post-purchase, too.

For example, if a couple purchases a home with a VA loan and then experiences a divorce, the civilian spouse is not automatically eligible to refinance the home with a VA loan. Since the VA loan is using the Veteran’s entitlement, they will likely have to VA refinance the loan to remove the civilian spouse unless they choose another loan type.

Speak with a Veterans United VA loan expert at 855-259-6455 to discuss your co-borrowing and co-signing options or get started online today.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Feb 12, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Minor content updates and fact checked by underwriter Don Wilson.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.