- A Certificate of Eligibility (COE) confirms you meet the military service requirements for a VA loan.

- The documents and qualifications needed to get your COE can vary based on your military status.

- Request your VA COE through your lender, apply online or submit a request by mail.

The VA requires lenders to obtain proof of a Veteran's military service during the VA loan process. The Certificate of Eligibility (COE) serves as proof to lenders that an applicant has officially met the VA's military service requirement.

That said, one of the most important things to know is that you do not need a COE in hand to start the VA loan process.

It's entirely possible to start the VA loan process and even get a preapproval letter without a COE. However, you or your lender must obtain the document before closing. The sooner the COE is in hand, the better because any delays or questions about the Veteran's military status down the road could halt closing or even upend the entire process.

What is a VA Certificate of Eligibility?

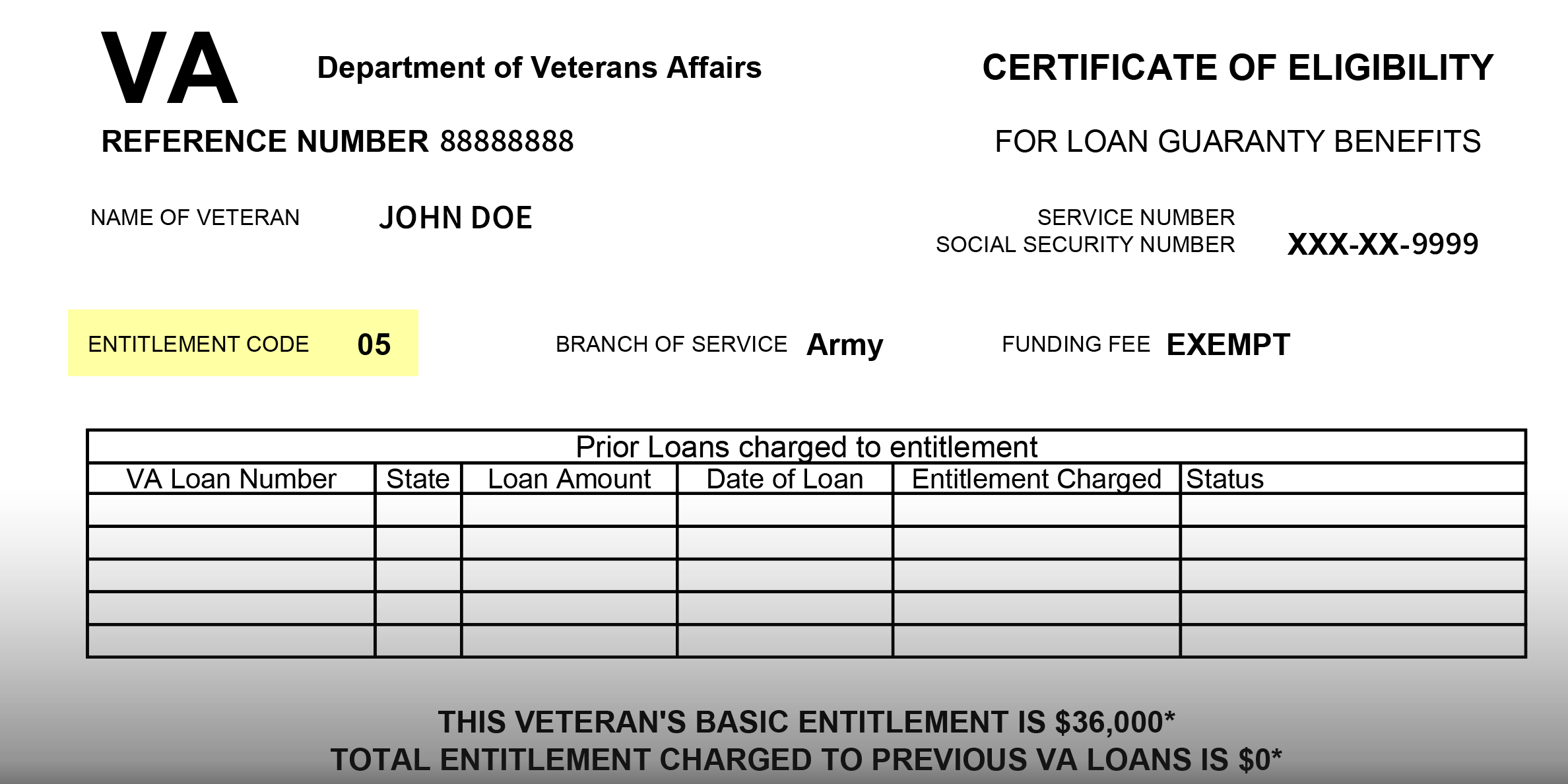

A Certificate of Eligibility, or COE, is a document from the Department of Veterans Affairs that confirms your eligibility for a VA loan. The COE also details your available VA loan entitlement and if you're required to pay the VA Funding Fee.

There is more than one way to obtain a COE, and while it's a short and simple document, it can stir up a lot of confusion. Let's clear up some of the most common questions around the Certificate of Eligibility.

What Does a Certificate of Eligibility Look Like?

A Certificate of Eligibility is a relatively simple document that displays basic information like:

- The VA reference number for the certificate

- The Veteran or service member's name

- The last four digits of your Social Security number

- Your branch of service

- Your entitlement code

Below is an example image of a Certificate of Eligibility:

How to Get a Certificate of Eligibility for a VA Loan

There are three ways to get your Certificate of Eligibility:

- Ask your lender. The easiest and best method of obtaining a COE, in our opinion, is going directly through your lender. Veterans United and other VA-approved lenders can tap into the Automated Certificate of Eligibility (ACE) database and often get your COE in seconds.

- Apply online. Go to the VA’s COE request page and log in or create a new account.

- Apply via mail. Print off VA Form 26-1880, fill it out and return it to the address on the form. The request should be processed within 4-6 weeks.

Who Qualifies for a VA Certificate of Eligibility?

To qualify for a VA Certificate of Eligibility, you typically must be a Veteran, active duty service member, National Guard member, Reservist or an eligible surviving spouse. Each group has its own specific service requirements, outlined below:

- Veterans: Served a minimum of 90 consecutive days during wartime or 181 consecutive days during peacetime and received an honorable discharge.

- Active Duty Service Members: Completed at least 90 consecutive days of active service during wartime or 181 days during peacetime.

- National Guard Members: Served at least six years in the National Guard or completed 90 days of active service under Title 10 orders, with at least one of those days during wartime.

- Reservists: Served at least six years in the Reserves or completed 90 days of active service under Title 10 orders during wartime.

- Surviving Spouses: Must be the un-remarried spouse of a Veteran who died during service or as a result of a service-connected disability.

How to Get Your COE as a Veteran

In most cases, the easiest way for Veterans to obtain their Certificate of Eligibility for a VA loan is to have a lender pull it directly from the government's automated database. Lenders can often do this with just a Veteran's Social Security number and birth date.

Depending on the nature of your service and other factors, additional documentation may be required, including DD Form 214, also known as a Certificate of Release or Discharge From Active Duty.

Generally, Member Copy 4 is the preferred copy of the DD214, as it has the most detailed information regarding the Veteran's service. You can determine which copy to submit by looking at the bottom right corner of the document.

How can you get your DD214? The U.S. National Archives and Records Administration provides a portal to request your form online.

How to Get Your COE as an Active Military Member

Those still serving on active duty may need to submit a current statement of service that denotes:

- Veteran's full name

- Social Security number

- Date of birth

- Branch of service

- Rank

- Active duty entry date

- Current date of separation

- Unit of assignment and current duty location

- Duration of lost time, if any

- Last discharge

- Type of discharge

- Name of the command providing the information

There isn't a standard form or format for the statement of service, but this roundup of information is common. The letter should be on official military letterhead.

How to Get Your COE as a Member of the Reserves or National Guard

Reservists and National Guard members don't have a single discharge certificate like DD Form 214. Instead, they should submit their latest annual retirement points summary along with evidence of their honorable service.

Army or Air National Guard members can submit NGB Form 22, a Report of Separation and Record of Service, or an NGB Form 23 points statement.

Like their Armed Forces counterparts, active members of the Reserves or National Guard must provide a signed statement of service that shows the required personal information. The statement also needs to clearly state that the applicant is an active Reservist or Guard member.

How to Get Your COE as a Military Spouse

To receive a Certificate of Eligibility as a surviving spouse, you need to first receive Dependency and Indemnity Compensation benefits. If you aren't currently receiving Dependency and Indemnity Compensation benefits, you need to fill out VA Form 21P-534EZ, Survivors Pension and/or Accrued Benefits. Once approved, follow the below steps.

If you are receiving Dependency and Indemnity Compensation benefits, you need to fill out a Request for Determination of Loan Guaranty Eligibility - Unmarried Surviving Spouses (VA Form 26-1817). You'll also need a copy of the Veteran's DD214 or other acceptable separation papers.

How to Read a Certificate of Eligibility

Once you get your Certificate of Eligibility, you'll notice an array of information, including your name, Social Security number, branch of service and even the name of the VA employee who issued your COE.

Most of it is clear and straightforward, but some items you may not recognize. One part that often leads to questions from prospective VA borrowers is the entitlement code, which is located at the top of the page.

This two-digit number gives VA lenders more information about your military service history and whether you may be exempt from paying the VA Funding Fee, an upfront cost that goes directly to the Department of Veterans Affairs when closing on a VA-backed or VA direct home loan.

It is important to know that borrowers receiving compensation for a service-connected disability, Purple Heart recipients on active duty and eligible surviving spouses do not have to pay this fee.

There are 11 possible VA entitlement codes. Most of the entitlement codes relate to a period of military service. But an important one for Veterans who've used their VA loan benefit in the past is Entitlement Code 05.

This entitlement code notes that a borrower who has previously obtained a VA loan has repaid the loan in full and restored the entitlement used on the property. Borrowers who've used a VA loan before are subject to paying a higher funding fee on future VA purchases unless their Certificate of Eligibility indicates they are exempt from the fee.

Talk with your loan officer if you have questions about your entitlement code or if you believe yours is incorrect.

VA Certificate of Eligibility (COE) FAQs

Obtaining your VA COE can be confusing depending on your service history and personal situation. Below are common questions about the application process and the VA eligibility certificate.

How Long Does it Take to Get a Certificate of Eligibility?

The time it takes to get a Certificate of Eligibility varies by how you apply. Requesting a COE by mail can take 4 to 6 weeks while applying online or with a lender typically takes minutes.

What if I Lose a Previously Issued Certificate of Eligibility?

If you lose your COE, it isn't a huge issue. You can apply for a new one through the three methods listed above: asking your lender, online or via mail.

Does the Certificate of Eligibility Guarantee I'll Get a VA Loan?

The Certificate of Eligibility is not a guarantee for a VA loan. The word "guarantee" frequently gets tossed into VA loan discussions, but to be clear, there is no VA loan guarantee just by meeting the basic service requirements.

The COE simply signifies that you've cleared one hurdle on the track — namely, that you've met the military service requirement. Your property still has to meet VA criteria, and your borrower qualifications (credit score, income and debts) must meet VA loan requirements and lender standards.

My Lender's Automated System Can't Determine My Eligibility. What Should I Do Now?

If your lender can't automatically obtain your Certificate of Eligibility, it could be from a few reasons that may include:

- Service members who had a prior VA loan go into foreclosure

- Service members who were discharged under conditions other than honorable

- Some Reservists and National Guard members

- Unmarried surviving spouses

Don't panic if you fall into this group. It occasionally happens, and VA lenders typically know how to handle it. In these cases, your lender will typically ask for your DD214 or points statement and send it directly to the VA for evaluation.

Does a Certificate of Eligibility Expire?

Your Certificate of Eligibility does not expire. However, don't plan to reuse an old COE if you're freshly starting the loan process. Your lender needs to verify your entitlement code, and you may need a new COE if you received your first while on active duty.

Do You Need a COE to Refinance a VA Loan?

Yes, you typically need a Certificate of Eligibility to refinance a VA loan, but the requirements can vary depending on the type of refinance you’re pursuing.

For a VA Streamline refinance, lenders usually only need proof that you’ve previously used your VA loan benefit. Your original COE for the VA loan purchase is often enough. In many cases, your lender can access this information electronically, making the process smoother.

If you’re opting for a VA Cash-Out refinance, a valid COE is required to verify your eligibility for the benefit. This type of refinance is treated more like a new VA loan, so the documentation requirements are a bit more involved. Either way, your lender can typically help you request or retrieve your COE if you don’t have it on hand.

Other Questions About Your VA COE?

Do you have any other questions about the COE? Contact a Veterans United VA loan expert at 855-870-8845 or get started online today.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

May 19, 2025

Written BySamantha Reeves

Reviewed ByDon Wilson

Content updates to improve readability and FAQ section. Article reviewed and fact checked by underwriter Don Wilson.

Related Posts

-

VA Loan Down Payment RequirementsVA loans have no down payment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements.

VA Loan Down Payment RequirementsVA loans have no down payment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements. -

5 Most Common VA Loan Myths BustedVA loan myths confuse and deter many VA loan borrowers. Here we debunk 5 of the most common VA loan myths so that you can borrow with confidence.

5 Most Common VA Loan Myths BustedVA loan myths confuse and deter many VA loan borrowers. Here we debunk 5 of the most common VA loan myths so that you can borrow with confidence.